In a rapidly changing environment, organisations must increasingly manage risk, pricing, and sustainability. With our array of products, CRIF is here to guide you through this difficult landscape.

CRIF offers real-time risk assessment and early fraud detection capabilities, allowing you to make quick and accurate decisions, and improve pricing strategies.

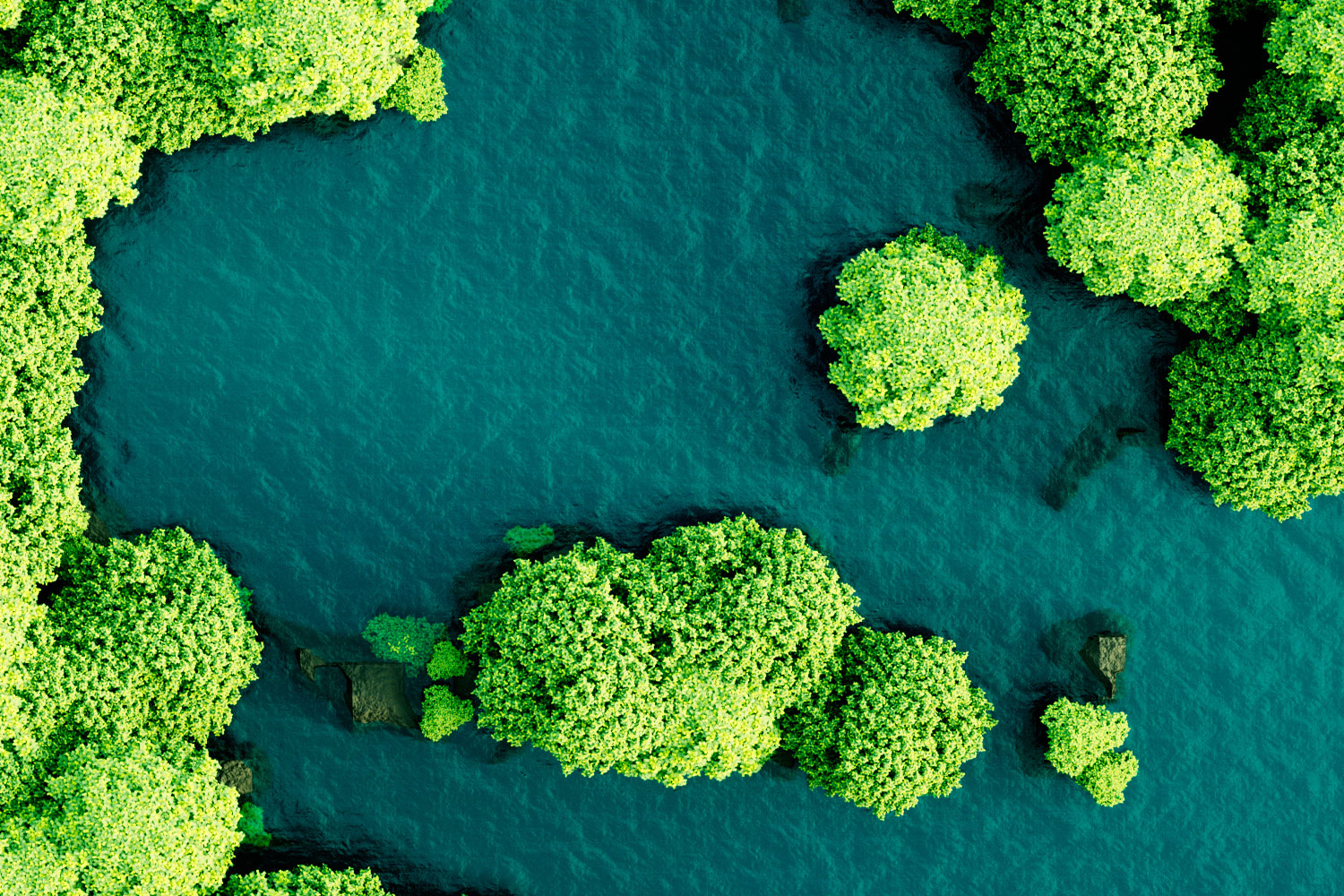

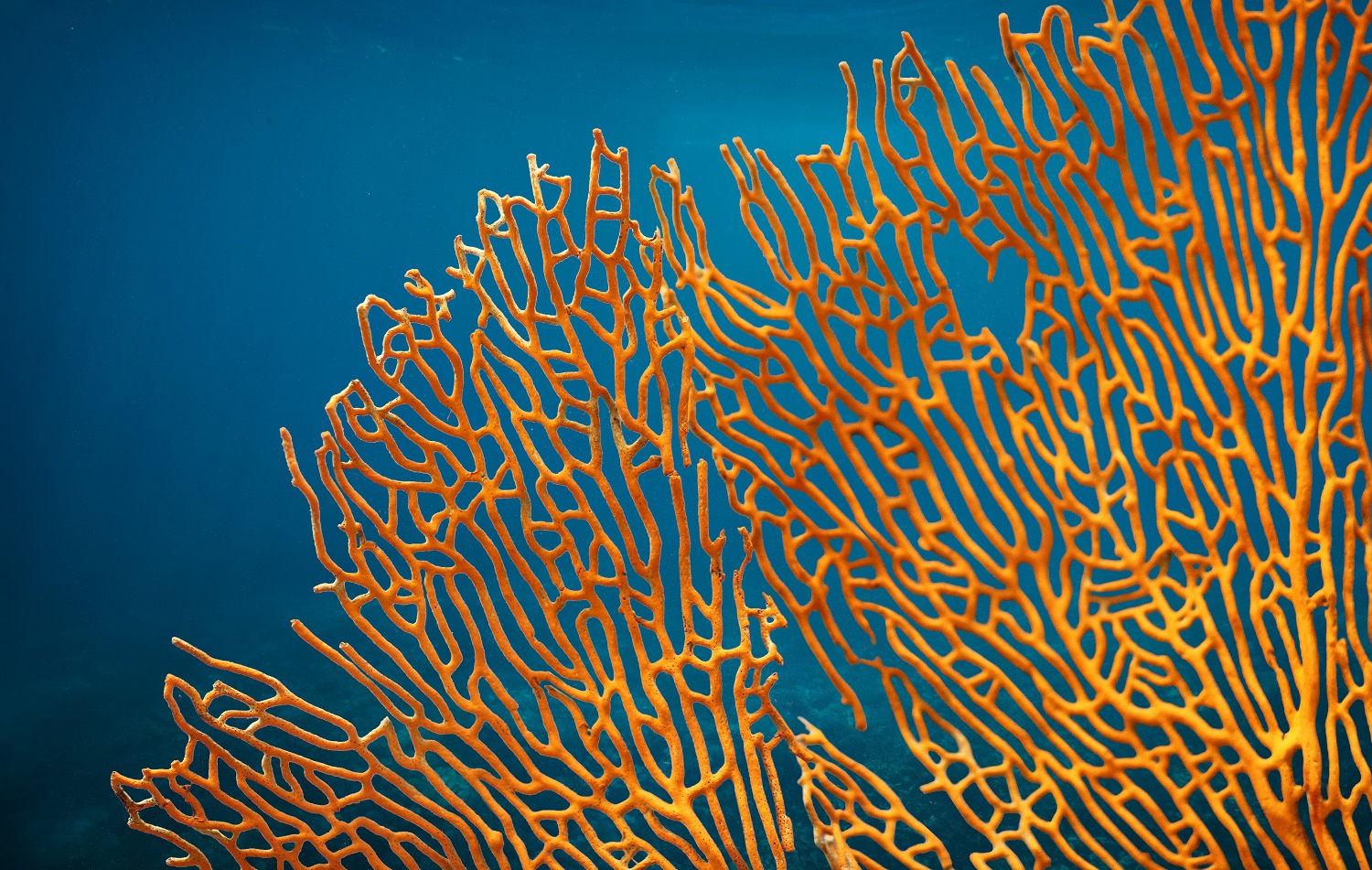

In an era where sustainability is critical, our ESG Solutions give your business the tools it needs to analyse and mitigate its environmental effect.

Discover these solutions and explore how CRIF can empower your business to navigate risk, pricing, and sustainability with confidence and ease.