How can insurers and brokers leverage the latest risk evaluation intelligence to quickly assess SME risks and price cover during, but especially after, the pandemic?

Restarting, stabilising, and adapting to a new supply-demand landscape is likely to be a top priority for most insurance providers. This will bring real challenges for many, as they try to adapt to new workflows, staffing capacity, credit flows, remote working and regulatory obligations, while at the same time attempting to balance the books.

When it comes to managing SME risks, pre-crisis data won’t be sufficient for evaluating your clients. However, it’s possible to gather accurate information at point of sale and renewal in order to optimise your business intelligence, and appropriately assess and price risks.

How can you improve credit risk assessment and SME customer profiling?

Here some of the areas you should look at:

- Uncovering and understanding information about any business and its stakeholders in the UK or across the world.

- Macro-economic forecasts about the likely business impacts on SMEs.

- Accurately identifying SME risks at point of quote or at a very early stage.

- Taking into account the importance of enhanced early warning triggers.

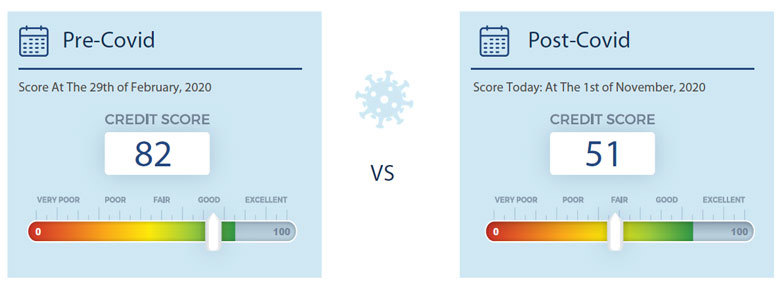

- Pre- and post-COVID scorecards to show a full and real picture of any business.

- Unlocking open banking opportunities to deepen your relationships with SME clients and leveraging real-time data.

- Screening new customers and prospecting.

- Performing AML compliance and due diligence checks to streamline your customer onboarding.

Uncovering and understanding information about any business and its stakeholders in the UK or across the world.

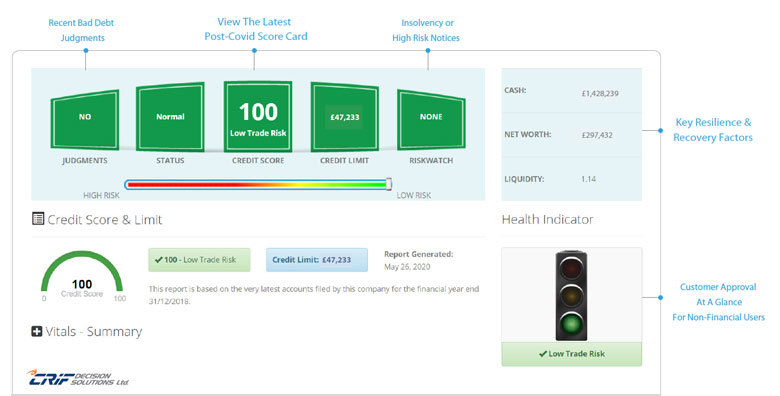

Insurers and brokers can uncover and understand information about any business and its stakeholders including company reports and documents held at Companies House, director searches, ownership structure, mortgages and charges, bad debt judgments, financial health checks and credit ratings. Such services can enable insurers to establish the identity and financial status of any company, business, director or sole trader in the UK and across the world. Accurate information at point of sale and the renewal and claims stage is crucial to effectively performing a risk assessment, fine-tuning your risk-based pricing approach and managing your claims process more confidently.

Macro-economic forecasts - what are the less or more likely business impacts on SMEs?

All macro-economic forecasts agree that there will be different impacts on different industries.

Certain industries linked to core needs (e.g. food & beverage, health, telco) will have a more limited or no negative impact, while other industries with a more social element (e.g. hotels & restaurants, leisure and travel) are and will face substantially greater challenges until the pandemic is over and all lockdown measures are fully lifted.

We can predict 5 main business impacts due to COVID:

1. Expected increase in credit default rates in both business and consumer portfolios

2. Expected explosion of Non-Performing Loans

3. Risk attached to customers will shift as credit payment holiday measures end

4. Expected increase in provisions and credit losses

5. New higher debt burden on companies as they look to begin repaying government liquidity support.

What are the main strategies for managing and mitigating risk?

The CRIF Decision Solutions’ multiple credit scorecard uses the latest risk evaluation intelligence. By combining recent financial, industry and company data with the latest real-time alerts and risk monitoring, you can assess risk quickly and tailor pricing more accurately.

Business Intelligence and Commercial Consumer Profiling to Enhance Your Portfolio Management.

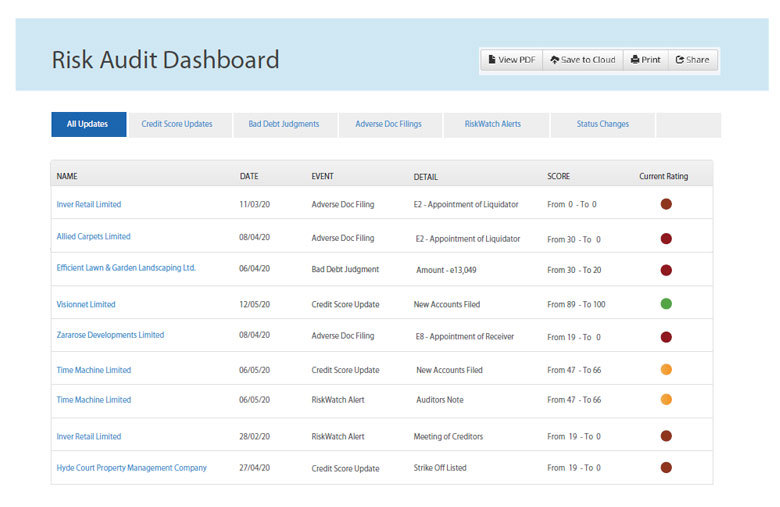

Want to know how to optimise your business intelligence activities? A good move would be to identify the higher risk customers in your portfolio using our batch screening solutions, including:

- Credit Score & Limit - Adverse Filings

- Bad Debts

- Risk Changes

The importance of early warning triggers to enhanced risk management.

Leveraging a full and updated credit profile with the Pre- & Post-COVID Scorecard

Companies who are well capitalised, with strong liquidity and in less affected industries are likely to be lower risk in the months ahead. By including a Pre-COVID score on our Credit Reports you can view the full credit history of a customer or supplier, and easily compare a company’s pre-crisis and post-crisis position, to make more informed decisions.

How data and insights can improve your customer management, from onboarding and AML compliance to sales and marketing.

A risk-based approach for effective customer onboarding.

As consumer spending decreases, tighter margins coupled with an increase in liquidations will likely lead to more widespread pre-screening of customer portfolios during onboarding, as well as scheduled reviews. Pre-crisis data won’t be sufficient for evaluating customer reliability. Trust that previously existed in business relations should be replaced by a risk-based assessment for evaluating your SME clients’ reliability and financial stability.

Grow your book of business by screening new customers and supporting marketing/sales activities.

Now more than ever, growing your business will be a two-step process: first, winning the sale, and second, appropriately pricing commercial insurance policies.

In a new cost-conscious environment, customers are likely to be less loyal and more open to movement based on price and value. With industries likely to emerge from hibernation at different rates, many forward-looking businesses will seek to take advantage of this new customer fluidity.

With the UK’s largest database of companies, CRIF can help you better manage your book of business by supporting your marketing and sales activities. Our solutions include:

- CRM integration of our data to empower your sales activities, pre-fill forms, fast-track customer approvals and ensure your team always knows more about any prospect.

- Importable pre-screened actionable data to help you drive lead generation. Highly targeted business lists focusing on growth industries to help identify your future customers, with positive ratings.

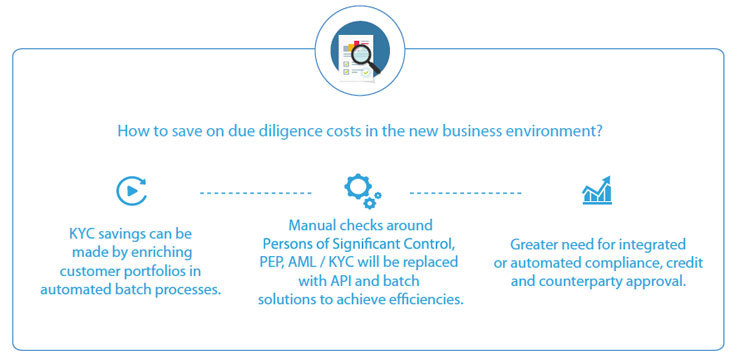

AML, Compliance & Due Diligence.

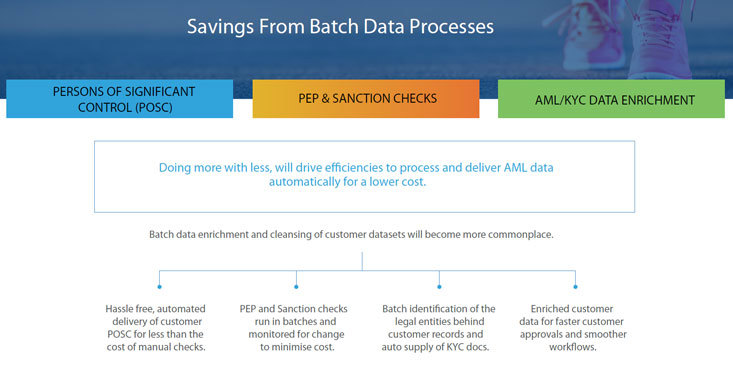

Organisations will probably face tough post-crisis challenges or changes driven by new customer needs. The areas of compliance, AML, KYC, due diligence and customer onboarding will likely experience a move towards cost cutting and process efficiency, as businesses look to do more with less. Manual processes and business checks will be reviewed, suppliers will be asked to deliver savings through more automated data workflows, either through batch data enrichment projects or API integration of KYC data directly into the heart of an organisation’s customer approval systems.

Customer approvals and onboarding will increasingly be performed digitally. What CRIF offers is a combined compliance, KYC, AML, and risk screening process to provide a consolidated view of multiple data sources into a convenient report for a faster decision-making process.

Savings from Batch Data Processes

Unlock Open Banking Opportunities to Deepen Your Relationship with SME Clients.

How can you take your business and consumer credit evaluation process to the next level?

A great opportunity is offered by open banking platforms, which can aggregate data coming from multiple banks and allow you to access real-time information and to know your customer better.

At its core, an open platform enables you to access your customers’ bank accounts through Open Banking and the PSD2 directive and retrieve current account bank information after obtaining your customers’ consent. Using bank account data in this way, you can provide personalised and relevant services, as well as strengthen and develop profitable opportunities. In addition, advanced scoring blended with Open Banking data can further boost decision-making processes.

CRIF offers insurers and brokers an innovative approach to commercial insurance.

By leveraging access and sharing banking data, CRIF will help you build services that are more targeted to the needs of your SME clients, and add a new dimension of value to your insurance propositions.

CRIF believes in the importance of ecosystems as a key source of growth and value. New opportunities exist for partnerships and distribution in wider cross-industry ecosystems, and new solutions are available to fully embrace Open Insurance.

How Can Insurers & Brokers Access Their SME Clients’ Open Banking Profiles?

SMEs are backbone of modern economies. CRIF provide tools to increase customer loyalty, add value and provide innovative services to SME customers with our direct to SME products, available as integrated or reseller solutions. Best in class, and provided on scalable architecture and delivered to CRIF standards, support and be seen to support small and medium businesses succeed.

By transforming today's complexities and challneges into concrete development opportunities, CRIF offers small and medium enterprises invaluable strategic and operational support for all phases of credit and marketing management, thanks to a range of integrated information solutions and tools that are unique in the market in terms of technology, know-how and performance.

The Drive Towards Digital Transformation.

Remote working, digital meetings, online stores, shared file hubs, and many more examples of business resilience have had a transformative effect on the way organisations, both large and small, now operate. And this digital drive is likely to continue.

In the current environment, the acceleration of digitalisation and disruption is one of the key driving factors of all activities. Never before have organisations experienced such a dramatic digital transformation in such a short period of time – a digital drive that is only likely to continue.

In response, CRIF’s expertise is continually adapting to complement the information needs of businesses. Supporting businesses across each wave of recovery going forward must be a priority and as a result, the ability to interpret the full value of information will become strategic to fast tracking progress, minimising bad debt and recovering turnover.

At CRIF, use of the latest risk evaluation intelligence allows us to combine financial, industry and company data with real-time alerts and risk monitoring to quickly assess risk and extend credit with more confidence in a more uncertain post-pandemic environment. These strategies and their execution are continually adapting in line with the rapidly changing environment, ensuring the best services for our customers.

CRIF's mission is to supply solutions to meet these needs and this evolving landscape.

By transforming market complexities into concrete development opportunities, CRIF offers its partners invaluable strategic and operational support in all phases of credit assessment, risk management and fraud prevention, thanks to a range of integrated information solutions and decision support systems that are unique in the market in terms of technology, know-how and performance.