Advanced AI and Machine Learning for Unparalleled Fraud Detection

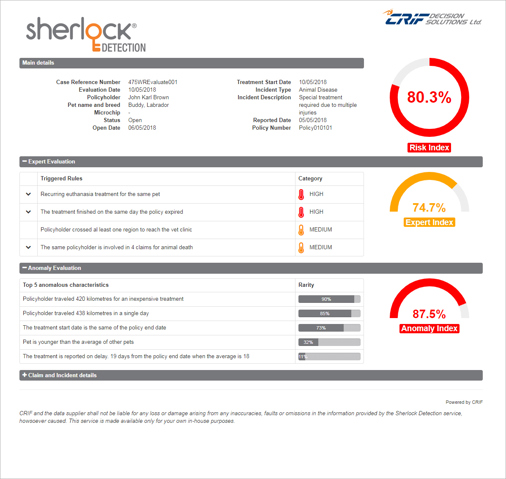

With Sherlock Detection, insurers can investigate 100% of their claims in just 3 seconds, identify hidden fraudulent connections, assess risks, and personalise your offer. CRIF AI and proprietary machine learning techniques, together with an insurance fraud analytics engine and more than 200 expert rules, empower you to optimise claims management, identify profitable areas and personalise your pricing.

Get an intuitive and comprehensive risk assessment report, including a fraud risk score.